reit dividend tax malaysia

Dec 2011 Male MYS. Frasers Property declared a dividend of 20 cents per share for FY2021.

General Property Trust was the first Australian real estate investment trust LPT on the Australian stock exchanges now the Australian Securities ExchangeREITs which are listed on an exchange were known as Listed Property Trusts LPTs until March 2008 distinguishing them from private REITs which are.

. However the dividend per share has significantly decreased compared to 86 cents in FY2016. From 1st until 30th January dividend is calculated as follow Account 1 dividend 70000 x 565 365 x 30 days 32507 Account 2 dividend 30000 x 565 365 x 30 days 13932 On 31st on January dividend is calculated as follow. 09 Mar 2012 0900 PM Post 1.

The REIT concept was launched in Australia in 1971. Are Global REITs The Way To Go. The latest entry into Malaysias robo-advisor scene.

Heres what you should look for to take your investments global the REIT way. Completed acquisition of Pangkor Laut Resort Tanjong Jara Resort Cameron Highlands Resort The Ritz-Carlton Kuala Lumpur Vistana Kuala Lumpur Vistana Kuantan and Vistana Penang as well as the remainder of The Residences at The Ritz-Carlton. One huge tax benefit of a REIT is that most income earned by it is exempted from income tax.

February 16 2022 ETF Investment. This allows the REIT to distribute its income on a gross basis. The management is being conservative as we go through this endemic phase of the pandemic.

Worldwide Real Estate Investment Trust REIT Regimes Compare and contrast 2 Introduction 3 Australia 4 Belgium 6 Brazil 11 Bulgaria 14 Canada 17 Finland 20 France 23 Germany 27 Greece 30 Hong Kong 34 Hungary 37 India 41 Ireland 46 Italy 49 Japan 53 Luxembourg 56 Malaysia 60 Mexico 64 New Zealand 68 Singapore 70 South Africa 75 South Korea 80 Spain 83 Taiwan 86. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax. This is a 333 year-on-year increase compared to 15 cents in FY2020.

Source-country tax on dividends will be generally limited to 15 subject to an exemption for dividends paid to certain pension funds or government investment funds beneficially holding less than 10 of the voting power in the company paying the dividend and a 5 limit that will apply to dividends paid to companies with voting power of 10 or greater in. This is how to calculate the dividend received by Mr M January 2009. EPF Announces Dividend Payout For 2021.

Reits Listed On Bursa Malaysia As At March 2016 Download Scientific Diagram

Finance Malaysia Blogspot Understanding Reits

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Etf Portfolios Investing Real Estate Investment Trust Trading

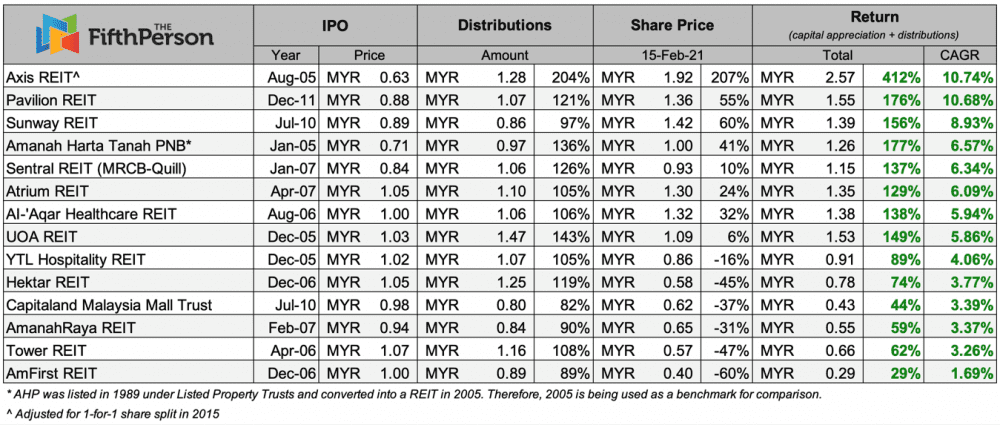

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Reit Regulatory Structure And Characteristics For Nigeria And Malaysia Download Table

Reits In Malaysia 8 Core Categories Of Real Estate To Invest In Propertyguru Malaysia

P2p Financing Travel Insurance Medical Insurance Investing

Reit Laws And Taxes Reit Asiapac

Top 10 M Reits By Market Cap Rm B Source Midf 2016 Download Scientific Diagram

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Chart Patterns Big M Big Chart Pattern

The Ultimate Guide To Investing In Reits In Malaysia The World Bizweek

Malaysia To Hold Key Rate Amid Nascent Recovery Decision Guide Bnn Bloomberg

5 Reasons Why You Should Invest In Reits Now By Jason How Zhi Yeong Smart Investor Medium